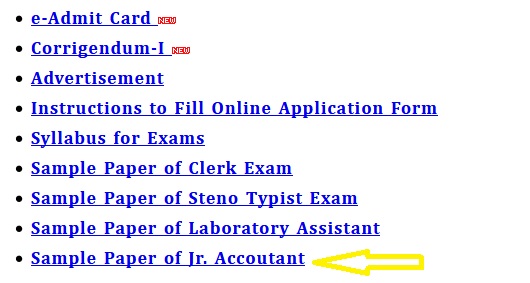

hppcb.nic.in Junior Accountant Question Paper Sample : Himachal Pradesh State Pollution Control Board

Organisation : Himachal Pradesh State Pollution Control Board

Post : Jr Accountant

Year : 2015

Document Type : Sample Question Paper

Website : hppcb.nic.in

Download Model/Sample Question Paper : https://www.pdfquestion.in/uploads/Recruitment/7189-JA.pdf

HPPCB Jr. Accountant Examination Sample Paper

Maximum Marks: 85

Time: 90 minutes

Note:

** Only one response to be selected and answered on OMR sheet. Each question carries one mark.

Related / Similar Question Paper :

HPPCB Laboratory Assistant Question Paper

** There will be negative marking for wrong answer or more than one answer for same question and half mark shall be deducted in each such question. No negative marking will be there for question left unattended.

Taxation

1) Calculate the exempt HRA from the following details:

X is entitled to a basic salary of Rs. 5,000 p.m. and dearness allowance of Rs. 1,000 p.m., He is also entitled to HRA of Rs. 2,000 pm. Actual Rent Paid by X Rs. 2000/- PM in Mumbai.

a) Nil

b) Rs. 16,800

c) Rs. 15,800

d) Rs. 20,800

2) Calculate Income-tax payable by an Individual (aged 30 years) for AY 2015-16 if his total income is Rs. 15,12,000:

a) Rs. 2,78,858

b) Rs. 2,86,598

c) Rs. 2,68,598

d) Rs. 2,86,958

3) Calculate the amount of rebate under section 87A in case of a resident individual having total income of Rs. 3,00,000.

a) Rs. 30,000

b) Rs. 10,000

c) Rs. 2,000

d) Rs. 5,000

4) Income accrued outside India and received outside India is taxable in case of:

a) Resident and ordinary resident (ROR) only

b) Resident but not ordinary resident (RNOR) only

c) Non resident only

d) ROR, RNOR and Non-Resident

5) A person follows Calendar year for accounting. For taxation, he has to follow:

a) Calendar year only – 1st January to 31st December

b) Financial year only – 1st April to 31st March

c) Any of the Calendar or Financial year as per his choice

d) He will to follow extended year from 1st January to next 31st March (a period of 15 months)

Economics

6) The best measure to see overall performance of an economy of a country is?

A. GDP

B. GNP

C. NNP

D. NNI

7) The term “Goods are scarce” means?

A. There is no supply of goods

B. There is no demand of goods

C. Goods are limited relative to desires

D. Goods are expensive because of shortage

8) When demand is price-inelastic, a price decrease __________ .

A. reduces total revenue

B. increases total revenue

C. reduces total demand

D. increases total demand

9) When a country’s currency falls in value relative to that of another country, the first country’s currency has undergone __________ .

A. depreciation

B. appreciation

C. devaluation

D. revaluation

10) National Income (or National Income at Factor Cost) = ?

A. NNP – Indirect Taxes

B. NNP – Subsidies

C. NNP + Indirect Taxes – Subsidies

D. NNP – Indirect Taxes + Subsidies

Commerce

11) Avoidable contract is one

a. Which is illegal.

b. Which cannot be enforced.

c. Which can be avoided subject to mutual contract.

12) A holding company is one which is having more than

A. 25% share in a subsidiary company.

B. 80% of share in subsidiary company.

C. None of above.

13) If due to some circumstances, no appointment of a new auditor or reappointment of the old auditor has been made in the annual general meeting of a company, then the

a) Old auditor will continue to work.

b) Board of Director will appoint the new auditor.

c) Managing Director can appoint the auditor.

d) Auditor may be appointed by the Central Govt.

14) As per the ICAI guidelines, for minimum how many years are auditor should maintain records relating to audit & other works done?

a) One year

b) Five year

c) Seven year

d) Ten year

15) The balance brought out between economic and social models of decision making as advanced by Herbert A. Simon is called

a) Rational model

b) Satisfying model

c) Irrational model

d) Satisficing model

Financial Accounting

16) Assets are held with a view to generate income while inventory of stocks are kept for sale

a) True

b) False

17) “Profit” and “Profitability” are two different concepts

a) True

b) False

18) Cash accounting and accrual base accounting will give same results if , there is no credit transaction

a) True

b) False

19) Retained earnings is the amount of money ploughed back into the business. How it is classified?

a) It is shown “on the liability side of the balance sheet”

b) It is shown as “current assets ”

c) It is shown on the “assets side” of the Balance sheet

d) It is shown as “current Liabilities ”

20) What is the Journal entry of Rent Paid to Shayam

a) Rent to Shayam

b) Rent to Cash

c) Shayam to Rent

d) None of these

21) Balance Sheet is a statement of sources of income and utilization thereof

a) Balance sheet pertains to a period of time

b) Balance sheet pertains to a point of time

c) Balance sheet reveals the result of operation of a business for a financial year

d) Balance Sheet shows balances in all account.

22) Net worth of a business means

a) Equity Capital

b) Total assets

c) Total assets – liabilities

d) Fixed assets – current assets

23) Current ratio indicates

a) Liquidity of the firm

b) Solvency of the firm

c) Profitability of the firm

d) None of the above

24) Financial accounting records only

a) Actual figures

b) Standards figure

c) Budgetary figure

d) None of the above

25) Errors of partial omission effect the agreement of the

a) Balance Sheet

b) Trial Balance

c) Both (a )& (b)

d) None of the above

26) Which of the following represents the accounting equation?

a) Capital = Assets+ Liability

b) Capital = Assets- Liability

c) Asset = liabilities – Capital

d) Liabilities =Assets + Capital

27) Stock in trade is a _____________

a) Fixed Assets

b) Fictitious Assets

c) Intangible Assets

d) Current Assets

28) Net worth of a business means________

a) Equity Capital

b) Total Assets

c) Total Assets – Total Liabilities

d) Fixed Assets – Current Liabilities

29) The immediate solvency ratio is __________

a) Quick Ratio

b) Current Ratio

c) Stock Turnover Ratio

d) Debenture Turnover Ratio

30) The maximum number of rows in a worksheet can be

a) 63655

b) 53665

c) 65536

d) 66553