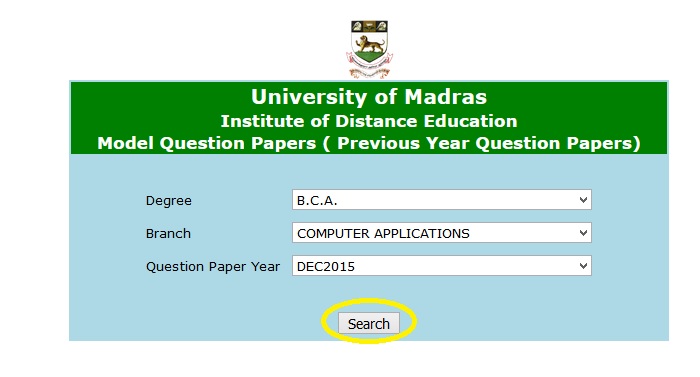

Financial,Cost & Management B.C.A Question Paper : ideunom.ac.in

niversity : University of Madras

Degree : B.C.A

Department : Computer Application

Subject :Financial,Cost & Management

Document type : Question Paper

Website : ideunom.ac.in

Download Previous/ Old Question Paper :

OCT 2013 :https://www.pdfquestion.in/uploads/ideunom.ac.in/6801-._DEC2013_uid46434%20UCCD.pdf

OC 2012 :https://www.pdfquestion.in/uploads/ideunom.ac.in/6801-._DEC12_uid46434%20UCCD.pdf

May 2013 :https://www.pdfquestion.in/uploads/ideunom.ac.in/6801-._MAY2013_uid46434%20UCCD.pdf

OCT 2011 :https://www.pdfquestion.in/uploads/ideunom.ac.in/6801-d11._QBNEW_uid46434%20UCCD.pdf

May 2011 :https://www.pdfquestion.in/uploads/ideunom.ac.in/6801-._MAY2011_uid46434%20UCCD.pdf

IDEUNOM BCA Cost & Management Question Paper

U/ID 46434/UCCD

Time : Three hours

Maximum : 100 marks

PART A — (10 × 3 = 30 marks)

Answer any TEN questions.

All questions carry equal marks.

Related / Similar Question Papers :

IDEUNOM BCA Cobol Programming Question Paper

OCTOBER 2011

1. Define dual aspect concept.

2. What do you mean by ‘‘Suspense Account’’? When it is prepared?

3. Define Average Due Date. When it is prepared?

4. Give formula for calculation of interest in account current.

5. State the important contents in Hire Purchase Agreement.

6. Define Investment Account. State two types of its preparation.

7. State the merits of marginal costing.

8. Define Bincard. Give one difference between bincard and stores

9. Define Break-even analysis.

10. State the uses of ratio analysis.

11. What are the different profit sharing ratios available in

12. Classify the budget according to time.

PART B — (5 ´ 6 = 30 marks)

Answer any FIVE questions.

All questions carry equal marks.

13. Explain errors not disclosed by Trial Balance.

14. Explain the profitability ratios.

15. Give various basis for apportionment of overheads.

16. How will you rectify the following errors discovered

(a) Rs. 3,000 spent for repairs of building has been posted to

(b) A sale of Rs. 5,200 to Suresh has been entered in the Sales

(c) Goods worth Rs. 500 purchased from Vishwam have been

17. A purchased goods from B, the due dates are as follows :

18. A and B were partners in a firm sharing profits in the ratio

19. From the following information calculate :

(a) Break even point. (b) Forecast the profit for sales volume

PART C — (4 × 10 = 40 marks)

Answer any FOUR questions.

All questions carry equal marks.

20. Discuss the features of a good wage system.

21. Describe the important managerial uses of ratio analysis.

22. Elucidate any four methods of calculation of depreciation.

23. Patel commenced business on 1.7.2003 with a capital of

24. A, B and C were partners sharing profits and losses in the ratio

25. Draw up a flexible budget for overhead expenses on the basis of

OCTOBER 2012

U/ID 46434/UCCD

Time : Three hours

Maximum : 100 marks

PART A — (10 ´ 3 = 30 marks)

Answer any TEN questions.

All questions carry equal marks.

1. What are the characteristics of single entry system?

2. Define account current. What are the methods for calculation

3. Define errors of principles. Give one example.

4. What are the accounting methods followed for department

5. State any three contents of hire purchase agreement.

6. Define cum-interest and Ex-interest pricing of securities.

7. What do you mean by profit and loss appropriation account?

8. Define ABC analysis.

9. Define overtime. Why it is necessary?

10. Define fund. What are its objectives?

11. Define Break-even point. State two merits of it.

12. Define can budget and flexible budget.

OCTOBER 2013

U/ID 46434/UCCD

Time : Three hours

Maximum : 100 marks

PART A — (10 ´ 3 = 30 marks)

Answer any TEN questions.

All questions carry equal marks.

1. Define error of commission. Give one example.

2. What do you understand by fixed installment method of depreciation?

3. State any two differences between Single entry and Double entry system.

4. What are the objectives of Branch accounts?

5. What are the three methods of accounting treatment for goods sent in sale of return basis?

6. State the advantages of departmental account?

7. Define partnership agreement.

8. Note any three differences between Bincard and storesledger.

9. State the effectiveness of labour turnover.

10. What do you mean by the term funds?

11. Define fixed cost and variable cost. Give one example for each.

12. What are the objectives of Budgetary control?

PART B : (5 ´ 6 = 30 marks)

Answer any FIVE questions.

All questions carry equal marks.

13. What are the distinctions between Branch a/c and departmental a/c?

14. Explain the advantages of ABC analysis.

15. Explain the factors governing incentive schemes.

16. Form the following information you have to prepare

(a) Break –even point

(b) Forecast the profit for sales volume Rs. 50,000. Fixed cost Rs. 13,000, variable cost Rs. 15,000, Total cost Rs. 28,000, Net profit Rs. 2,000, Net sales Rs. 30,000

17. Mr. Sampath completes a work in 120 hours as against 140 hours allowed. His hourly rate is Rs. 5. He gets a D.A. of Rs. 16 per day of 8 hours work, in addition to his wages. Calculate his total earnings under Rowan plan.

18. X L.td. has submitted the following Balance sheet for the year ending 31st December 2010.

Liabilities Rs. Assets Rs.

Equity capital 150,000 Fixed Assets 1,62,000

Reserve 30,000 Stock 22,000

8% Debentures 20,000 Debtors 51,000

Sundry creditors 49,000 Bills Receivable 2,000

Bank 12,000 2,49,000 2,49,000

Find the current ratio and liquidity ratio.

19. Calculate the economic order quantity and number of orders placed during the year:

Annual consumption 120 units

Buying cost per order Rs. 20

Per unit Price Rs. 100

Storage and carrying cost as a% of average inventory 12%.

PART C : (4 ´ 10 = 40 marks)

Answer any FOUR questions.

All questions carry equal marks.

20. Discuss the features of a good wage system.

21. Describe the advantages of LIFO method of stores.

22. Enumerate the kinds of capital accounts prepared in partnership account.

23. On 1st January 2009, X owed Rs. 5000 to Y on account. During the three months ended 31.3.09 the transactions were as follows in the banks of Y.

Jan 10 Received two bills for 2 months and 3 months respectively

from X Rs. 2,000 each

Feb 9 Paid cash to X Rs. 1,000

Feb-19 Received cash from X Rs. 1,000

Feb–1 Sold goods to X. Rs. 1,000

Mar-13 X’S acceptance due this day dishonoured Rs. 1,000

Prepare account current to be rendered to X on 31.3.2009, interest to be reckoned at 9% p.a.

24. On. 1.1.2005 Java purchased a machinery under hire purchase system, Rs. 15,000 being paid on delivery and the balance amount in 5 annual installments of Rs. 10,000 each payable on January 1 each year. The cash down price of the machinery is quoted at Rs. 50,000 depreciation @ 10%p.a. on straight line method to be charged. Calculate machinery account for 5 years.

25. The expenses for budged production of 10,000 units in a factory are furnished below.

Per unit (Rs.)

Material 70

Labour 25

Variable overhead 20

Fixed overhead (Rs. 1,00,000) 10

Variable expenses (Direct) 5

Selling expenses (10% fixed) 13

Distribution expenses (20% fixed) 7

Administrative expenses (Rs. 50,000) fixed 5

Total cost per unit 155

Prepare a budget for production of:

(a) 8,000 units

(b) 6000 units

I want repeated questions with answers in PDF if you post like that, its very useful to us.

Need important ten mark questions that are asked repeatedly or some important questions.