www.dhsekerala.gov.in Accounting With Afs Model Question Paper : HSE /Plus Two /12th Std /+2

Board : Higher Secondary Education, Government Of Kerala

Exam : HSE Accounting With Afs

Document type : Question Paper

Website : dhsekerala.gov.in

Download Sample/ Model Question Papers :https://www.pdfquestion.in/uploads/6029-08125_1_51_IJK.pdf

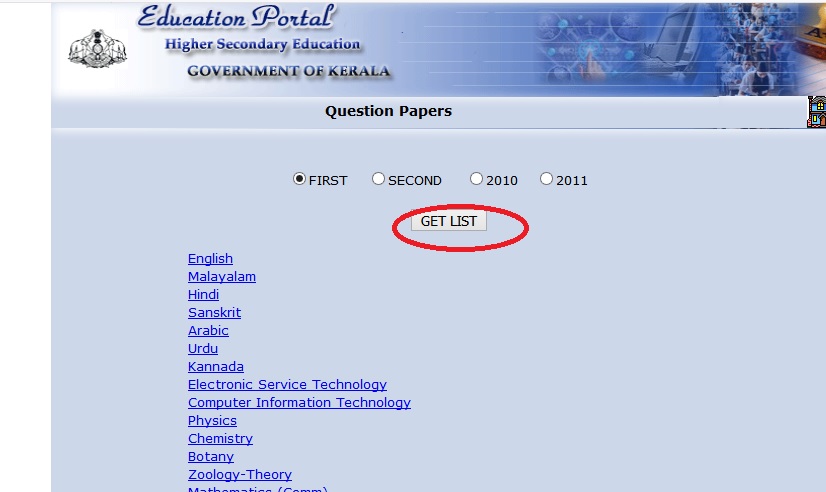

Download All Question Papers : http://dhsekerala.gov.in/ques_download.aspx

DHSE Kerala Accounting With AFS Sample Question

FIRST YEAR HIGHER SECONDARY EXAMINATION

Max.Score : 80

Time : 21/2 Hrs

1) A proprietor brings furniture worth Rs.15000/- and cash Rs.25000/-

2) Find the correct one Assets+ capital=Liabilities Assets+ Liabilities=Capital Capital

Related / Similar Question Paper :

DHSE Kerala HSE Business Studies Question Paper

3) Name the source document of purchase return

4) Machinery purchased from M/S Bharath Earth movers ltd is recorded

5) Provision for bad debt is created on the basis of ———principal

6) Drawings a/c Dr. 10000 To ————– 10000

7) When a transaction is recorded on opposite side of cash book,

8) Wages paid for the erection of machinery is debited to wages a/c.

9) Under diminishing balance method, depreciation is calculated on the ——-

10)DBMS stands for —————

11)Name the statement prepaid to check the arithmetical accuracy of accounts.

12)Usually—————-account is prepared to find out Credit sales

13) People interacting with computers are called————–

a) Application soft ware b) Live ware c) Hard ware

14) ‘Pay Rahim only’ identify the type of endorsement

15) Cash book never shows ——- balance ( Score 1×15=15)

Sample Question

16) State whether the following statement are true or false. If false correct it.

a) Gross loss is the excess of sales over cost of goods sold.

b) Provision is an appropriation of profit

c) Amount spent for the purchase of sports goods by a sport club

d) Overdraft for the business is indicated by credit balance in the cash book

e) Accounting Entities concept seeks to make a distinction between business

a) Depletion a) Appropriation of profit b) Petty cash book b) Charge against profit

c) Reserve c) Wasting assets d) Non profit entities d) Imprest system

18) On the basis of the Bills of Exchange given below, answer the following

19) What are the merits of computerized accounting? (Score 3)

20) From the following transaction of Ajay furniture mart, Prepare Sales book.

21) Calculate credit sale from the particulars given below

22)Mr.Kumar keeps his book under single entry system and following

23)Raju purchased machinery on January 2008 for Rs.50000/- and decided

24) Rahul accepted a bill for Rs.3000/- drawnby Dhoni

26) Prepare a Bank reconciliation statement from the following information

a) Bank overdraft as per cash book as on 31st may 2010 Rs.5100/-

b)cheque sent for collection but not cleared Rs.670/-

c)cheque issued but not paid for yet Rs.1300/-

d)interest on investment credited in pass book Rs.810/-

e) Interest on overdraft debited in passbook Rs.400/-

f) Cheque issued and paid but failed to record in the cash book Rs.490/- ( Score 8)

20) The Receipt and Payment account of Adithya Arts club for the year ending 31/12/2010 is given below.

Addition information

a)stock of stationary on 31.12.2010 was Rs.50/-

b) Subscription outstanding on 1.1.2010 was Rs.250/-and on 31.12.2010 was rs.350/-subscription received in

advance in 2009 for 2010 was Rs.400/- and for 2011 was RS.450/-

C) Depreciation charged on sports goods for the year 2010 was Rs.140/-

You are required to prepare Income and Expenditure Account for the tear ended 31.12.2010. (Score 9)

Additional Question

a) salaries outstanding Rs.500

b) Rent received in advance Rs.500

c) Write-off bad debt Rs.1000/-

d) Provide 5% on debtors for doubtful debt

e) Depreciate Land and building @10%

f) Manager is entitled to a commission @10%on net profit before charging such commission. (Score 12)

OR

Prepare a double column cash book wth cash and bank column from the following transaction

2010 Jan 1 Cash balance 2200

Bank balance (Cr) 3500

2 cash sales 3900

5 cash purchase 2600

7 withdrew from bank 1500

9 paid to suhail by cheque 1450

11 personal withdrawal from bank 600

13 received a cheque from mohan 9500

14 Cheque from Mohan was paid into bank 9500

17 paid cash for postage 150

19 Rahul one of the customer paid directly into our bank account 3000

23 withdrew cash from bank for office use 1000

24 paid into bank 900

27 Received a cheque from Kishore and the same was given to bank collection 7200

28 Mohan’s cheque was returned dishonoured 9500

29 Paid salary by cheque 1000

30 Bank charges debited in the pass book 40

30 Interest credited in the pass book 120

31 paid David by cheque 1350

(score 12)

This is very helpful to us.

Please help me to find cash flow statement.

Please help me to find accounting for share capital.

HOW WILL CASH FLOW STATEMENT HELP IN ACCOUNTING? PLEASE HELP ME.

Please help to find new ratio.

Old Ratio (-) New Ratio.