mpscmanipur.gov.in MPSC Limited Departmental Examination Inspector of Taxes Previous Year Question : Manipur Public Service Commission

Organisation : Manipur Public Service Commission

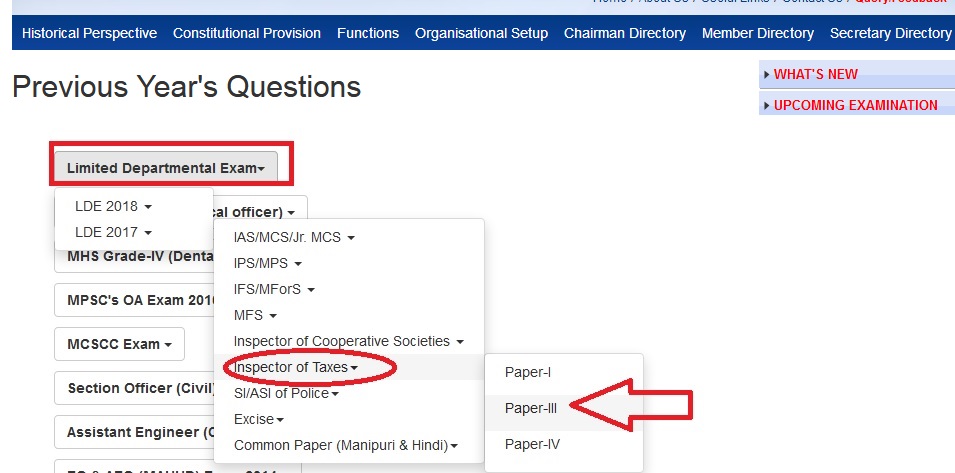

Exam : Limited Departmental Examination

Post : Inspector of Taxes

Subject : Paper – I,II,III,IV

Year : 2017

Document Type : Previous Year’s Questions

Website : https://mpscmanipur.gov.in/question.html

MPSC LDE Inspector of Taxes Previous Year Question

Time Allowed: Two Hours

Maximum Marks: 100

Related : Manipur Public Service Commission MPSC LDE Cooperative Officers Previous Question : www.pdfquestion.in/33183.html

Instructions

1. Immediately after the commencement of the examination, you should check that this Test Booklet does not have any unprinted or torn or missing pages or items, etc. If so, get it replaced by a complete Test Booklet.

2. Write your Roll Number on the Test Booklet in the Box provided alongside.

3. This Test Booklet contains 100 items (questions). Each item comprises four responses (answers) written as (a), (b), (c) and (d). You will select the response which you feel is correct and want to mark on the answer sheet.

4. You have to mark all your responses ONLY on the separate Answer Sheet provided. Also read the directions in the Answer Sheet. Fill in all the entries in the Answer Sheet correctly, failing which your Answer Sheet shall not be evaluated.

5. Count the number of questions attempted carefully and write it down in the space provided in the OMR Sheet. This has to be verified by the Invigilator before leaving.

6. After you have completed filling in all your responses on the Answer Sheet and the examination has concluded you should hand over to the Invigilator the Answer Sheet (in original). You are permitted to take away 2nd Copy of OMR Answer Sheet and the Test Booklet.

7. All items carry equal marks.

8. Candidature would be cancelled in case of non-compliance with any of these instructions.

9. There will be NO PENALTY for wrong answers.

Download Question Paper :

Paper – I :

https://www.pdfquestion.in/uploads/33191-LDEPaI.pdf

Paper – III :

https://www.pdfquestion.in/uploads/33191-LDEPaIII.pdf

Paper – IV :

https://www.pdfquestion.in/uploads/33191-LDEPaIV.pdf

General & Mercantile Law

1. Which one of the following is not a “Public Servant” under IPC?

a) Liquidator

b) A Civil Judge

c) Member of a Panchayat assisting a Court of Justice

d) Secretary of a Co-Operative Society.

2. Offences relating to contempt of the lawful authority of public servants, is dealt in

a) Chapter IX of IPC

b) Chapter X of IPC

c) Chapter XI of IPC

d) Chapter XII of IPC.

3. Persons falling under section 21 of IPC

a) Should be a public servant appointed by the Government

b) Should be a public servant which may not be appointed by the Government

c) Should be a public servant which may or may not be appointed by the Government

d) None of the above.

4. Mr. Thoiba, being legally bound to appear before the District Judge, as a witness in obedience to a summons issued by that District Judge intentionally omits to appear. Mr.Thoiba has committed the offence of

a) Preventing service of summons or other proceeding, or preventing publication thereof

b) Omission to produce document to public servant by person legally bound to produce it

c) Non-attendance in obedience to an order from public servants

d) Furnishing false evidence.

5. A gives false evidence before a Court of Justice, intending thereby to cause Z to be convicted of a dacoity. The punishment of dacoity is imprisonment for life, or rigorous imprisonment for a term which may extend to ten years, with or without fine. A therefore is liable to

a) Imprisonment for life or imprisonment, with or without fine

b) Not liable to imprisonment for life

c) Rigorous imprisonment for a term of six years

d) None of the above.

6. Omission to assist public servant when bound by law to give assistance, is provided under

a) Section 175 of IPC

b) Section 182 of IPC

c) Section 172 of IPC

d) Section 187 of IPC.

7. Under the provision of IPC, fraudulent removal or concealment of property to prevent its seizure as forfeited or in execution shall be punished with

a) Imprisonment of either description for a term which may extend to five years, or with fine, or with both

b) Imprisonment of either description for a term which may extend to four years, or with fine, or with both

c) Imprisonment of either description for a term which may extend to three years, or with fine, or with both

d) Imprisonment of either description for a term which may extend to two years, or with fine, or with both

8. The printing or publication of the judgement of any High Court or the Supreme Court does not amount to an offence within the meaning of

a) Section 222-A of IPC

b) Section 225-A of IPC

c) Section 228-A of IPC

d) Section 228-B of IPC.

9. Under the provision of section 201 of IPC, A, knowing that B has murdered Z, assists B to hide the body with the intention of screening B from punishment. A is liable to

a) Imprisonment of either description for seven years

b) Imprisonment of either description for seven years, and also to fine

c) Imprisonment of either description for twelve years, and also to fine

d) Imprisonment of either description for twelve years.

10. “Harbouring offender” is provided under

a) Section 190 of IPC

b) Section 202 of IPC

c) Section 212 of IPC

d) Section 220 of IPC.

11. Under the provision of IPC, an order is promulgated by a public servant lawfully empowered to promulgate such order, directing that a religious procession shall not pass down a certain street. A knowingly disobeys the order, and thereby causes danger of riot. A has committed the offence defined under

a) Section 182

b) Section 188

c) Section 200

d) Section 222.

12. Cognizable offence under IPC has been defined

a) Under section 2(a) of Cr.PC

b) Under section 2(c) of Cr.PC

c) Under section 2(i) of Cr.PC

d) Under section 2( l) of Cr.PC.

13. Classification of offences given in the Code of Criminal Procedure under

a) Section 320

b) The First Schedule

c) The Second Schedule

d) Section 482.

14. Complaint, as provided under section 2(d) of CrPC

a) Can be in writing only

b) Can be oral

c) Either in writing or oral

d) Can be by gestures.

15. Summon-case is provided under

a) Under section 2(s) of Cr.PC

b) Under section 2(t) of Cr.PC

c) Under section 2(u) of Cr.PC

d) Under section 2(w) of Cr.PC

Book Keeping & General Commercial Knowledge

1. Who are not interested in the accounting information of a business

a) Money Lenders

b) Officers

c) Employees

d) Management

2. In accounting, recording is made of

a) Personal transactions of the proprietor

b) Financial and non-financial transactions

c) Financial transactions

d) Non-financial transactions.

3. Which of the following is Capital expenditure?

a) Wages and Salaries paid

b) Wages paid for building construction

c) Repairing expenses of Machine

d) Publicity expenses of business

4. Discount is the amount which is received:

a) At the time of payment

b) At the time of Selling Goods

c) At the time of purchase of Goods on credit

d) Both at the time of payment and receipt.

5. Tangible assets do not include:

a) Furniture

b) Cash

c) Good will

d) Stock

6. Convention of Prudence takes into account:

a) All future profit and losses

b) All amount receivables

c) All future losses and uncertainties

d) Neither profits nor losses of the future

7. Fixed liability is:

a) Bank over-draft

b) Creditors

c) Long term loan

d) Short term loan.

8. Goods include purchase of all

a) Commodities

b) Assets

c) Commodities for resale

d) Liquid commodities only.

9. Dead stock includes:

a) Land and Building

b) Debtors

c) Creditors

d) Investments.

10. Which concept separates a proprietor from the business?

a) Going concern concept

b) Cost concept

c) Business entity concept

d) Account period concept

11. Contingent liabilities are shown in the Balance Sheet under:

a) Convention of Consistency

b) Convention of Full Disclosure

c) Convention of Materiality

d) Going Concern Concept

12. Revenue is considered as being earned when:

a) Cash is received

b) Production is made

c) Sale is effected

d) Agreement of Sale is entered.

13. Accounting standards are necessary due to:

a) Regional business purposes

b) National Budget accounting

c) Globalisation of business

d) National Income Accounting.

14. Accrual System is based on:

a) Dual aspect concept

b) Cost concept

c) Materiality concept

d) Matching concept

15. Credit balance of nominal account shows:

a) A liability

b) An asset

c) An income

d) An expense

Accounts & Office Procedure

1. An employee holds lien on a post –

(a) While on foreign service ;

(b) During joining time on transfer to another post ;

(c) While under suspension ;

(d) All of the above.

2. A Government servant can hold lien on the post in his parent department, while getting employed in other department, for a period of –

(a) One year ;

(b) Two years ;

(c) Three years ;

(d) Five years.

3. Lien of a permanent employee on foreign assignment on Government to Government basis to developing countries of Asia, Africa and Latin America, may be extended upto –

(a) Two years ;

(b) Three years ;

(c) Five years ;

(d) Six years.

4. Lien on a post shall stand terminated if the employee –

(a) Acquires lien on a permanent post outside his parent cadre ;

(b) Proceeds on immediate absorption basis to a post/service outside his service/cadre/post ;

(c) Overstays at foreign service/deputation beyond the maximum permissible period ;

(d) All of the above.

5. Pay means the amount drawn monthly by a Government servant, in terms of –

(a) FR 9(20) ;

(b) FR 9(21)(a) ;

(c) FR 9(23) ;

(d) FR 9(25).

6. Overseas pay means –

(a) Pay of a Government servant remitted abroad ;

(b) Pay granted to a Government servant for his services abroad ;

(c) Pay granted to a Government servant for his services in a country other than the country of his domicile ;

(d) None of the above.

7. Substantive pay means pay other than –

(a) Special pay ;

(b) Personal pay ;

(c) Emoluments classed as pay

(d) All of the above.

8. Personal pay means additional pay granted to a Government servant –

(a)To save him from a loss of substantive pay due to revision of pay ;

(b)To save him from a loss of substantive pay due to reduction of substantive pay for any reason except disciplinary action ;

(c)In exceptional circumstances, on other personal considerations ;

(d) All of the above.

9. Special pay or special allowance is an addition to the emoluments of a post or of a Government servant for –

(a) Special achievements of the Government servant ;

(b) Specially arduous nature of duties ;

(c) Specific addition to the work or responsibility ;

(d) Both (b) and (c) above.

10. Special pay (allowance) is admissible for –

(a) Cash handling duties of a cashier ;

(b) Assisting cashiers in bringing cash from bank ;

(c) Operating franking machines / Photostat machines / Gestener ;

(d) All of the above.

11. The current rate of Cash Handling Allowance to cashiers for handling an amount of average monthly cash disbursed of over Rs. 10 lakhs is –

(a) Rs. 600 p.m. ;

(b) Rs. 750 p.m. ;

(c) Rs. 900 p.m. ;

(d) Rs. 1000 p.m.

12. Monthly grant made to a Government servant who is not in receipt of pay or leave salary is –

(a) Personal grant ;

(b) Grant-in-aid ;

(c) Subsistence grant ;

(d) Substantive grant.

13. Existing basic pay does not include

(a) Dearness allowance ;

(b) Non-practicing allowance ;

(c) House rent allowance ;

(d) All of the above.

14. The pay of a Government servant whose promotion or appointment to a post is found to be or have been erroneous, shall be regulated under –

(a) FR 22 ;

(b) FR 23 ;

(c) FR 27 ;

(d) FR 31-A.

15. Family planning allowance is allowed to a male Government employee if his age at the time of sterilization operation does not exceed 50 years and that of his wife does not exceed –

(a) 45 years ;

(b) 48 years ;

(c) 50 years ;

(d) 55 years.